You May Be Eligible for the R1.8 Million Capital Gain Exclusion

55 years =

- 660 months

- 2,867 weeks

- 20,075 days

- 481,800 hours

- 28,908,000 minutes

- 1,734,480,000 seconds AND

- R1,800,000 TAX FREE.

Who Knew Turning 55 Could Be This Good?

Most people turning 55 start considering their options of selling their small businesses to retire early. However, due to tax concerns many people are concerned that they may end up penniless in old age after SARS took their cut. Prices will continue to increase and petrol will go up. It is imperative to ensure that you have enough money to sustain the lifestyle to which you have become accustomed.

Running a small business can be unsettling and risky. The good news is that there are special concessions available for small business owners when it comes to selling their business and Capital Gains Tax (CGT).

SARS gives you a R1,800,000 exemption when it comes to selling your small business (Paragraph 57 of the Eighth Schedule to the Income Tax Act).

How the CGT Exemption Works

If you are:

- A sole proprietor, or

- A partner in a partnership, or

- A person holding at least 10% of the equity interest in a company, and at the time of disposal you:

- Owned the business or held the asset for your own benefit for a continuous period of at least five years;

- Were substantially involved in the day-to-day operations of the business and have reached the age of 55,

then you qualify for this tax exemption.

All of the capital gains must be realised within a period of 24 months from the date of disposal. If a person owns or has interest in more than one business, this exclusion will not be available if the total market value of all assets in all businesses exceed R10 million.

Examples of the CGT Exemption in Action

Understanding complex business tax treatment, especially if accounting is not your forte, is challenging and not for the faint-hearted. However, knowing the basics is essential for your own success.

MTC:

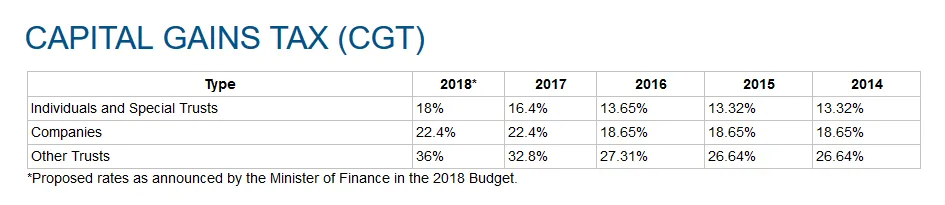

Here are the different taxation rates for each type of entity:

Below are two brief examples to help you understand this exemption:

Example 1 – Sole Proprietorship

James runs a tyre shop as a sole proprietor and he owns the property where the shop operates. He purchased the building seven years ago and he has been involved in running the business since then. He bought the building for R1,000,000 and it’s being sold as part of the tyre shop’s assets for R5,000,000. John has also built up a large portion of goodwill in his business. The CGT calculation will be as follows:

Selling price of building: R5,000,000

Less: Purchase price of building (base cost): R1,000,000

Capital gain on building: R4,000,000

Plus: Value of goodwill forming part of sale: R600,000

Capital gain: R4,600,000

Less: CGT small business exemption: R1,800,000

Net capital gain: R2,800,000

Capital Gains Tax: Your capital gains tax would have amounted to R828,000 (4,600,000 x 18%) without the exclusion and roughly R504,000 (2,800,000 x 18%) with the exclusion.

Example 2 – Interest in a Company or Closed Corporation (CC)

Sofia bought a 50% interest in a CC 10 years ago. At that time it cost her R2 million. The CC owns a bakery and Sofia has been actively involved in running the business for the past decade.

When Sofia reached the age of 55 she decided to sell her interest and received R4,000,000 from the sale. Her capital gains tax calculation will be as follows:

Selling price: R4,000,000

Less: Cost price (base cost): R2,000,000

Capital gain: R2,000,000

Less: CGT small business exemption: R1,800,000

Net capital gain: R200,000

Capital Gains Tax: Sofia’s capital gains tax has gone from roughly R360,000 (R2,000,000 x 18%) if the exclusion was not used to R36,000 (R200,000 x 18%) using the R1.8-million exclusion.

This is presuming, however, that the business in which she sold her member’s interest was still active and trading.

It is important to note is that the R1.8 million exclusion is cumulative over your lifetime and may only be utilised if you are 55 years and older. Thus if you sell your business at 55 and use the exclusion, then no further exemption will be available for you to use upon the sale of other small business assets.

Conclusion

Are you thinking of selling your small business and retiring, but you are worried that you are going to lose a considerable amount of your capital investment? Don’t pay SARS more than you should. Take a second, investigate your options and ask Contador Accountants to explain the Capital Gains tax implications specific to your situation.