No-one starts a business just to keep busy. We do it because we want financial freedom, or we want to help people, or we want to pursue a dream – usually all three. To reach those goals, we need to make money, and if our businesses aren’t healthy, we can’t make money.

Unfortunately, many business owners don’t know how to measure the health of their business. Though understandable – after all, you’re not an accountant – but flying blind can cost you your dream. Almost 80% of all South African start-ups fail within three years, according to statistics by SME South Africa.

Here are a few ratios that can help you to determine whether your business is doing well or not in the short term. Don’t wait to track these ratios until you’re in a crunch. Measure it from the start, and if you see that your ratios are unfavourable or your business health is declining, you can take action immediately before it’s too late.

1. Current Ratio

The current ratio measures your current assets in relation to your current liabilities. This ratio is used to measure solvency, in other words, whether you’ll be able to pay your debts when they become due.

Your current assets consist of money in the bank, cash, inventory, and your debtors – any assets that you can turn into cash quickly. Your current liabilities consist of your bank overdraft and your creditors, including money owed to SARS.

Example

Let’s assume the following:

Current assets: R300,000

Current liabilities: R100,000

Calculation:

Current assets / current liabilities

= 300,000 / 100,000

= 3

Ratio:

Current assets to current liabilities = 3:1

Conclusion:

The higher the current ratio, the better, but you want to aim for a ratio of at least 2:1.

If your current assets are less than 1, you’re in trouble.

2. Quick Ratio

The quick ratio is similar to the current ratio, except that you take inventory out of the picture. It can take a while to sell your stock, depending on your industry, which means you might not always be able to sell it in time to pay your current debts. This ratio measures whether you have enough immediate funds to cover your short-term debts.

Example:

Let’s assume the following:

- Current assets: R300,000

- Inventory: R150,000

- Current liabilities: R100,000

Calculation:

(Current assets – inventory) / current liabilities

= (300,000 – 150,000) / 100,000

= 1.5

Ratio:

Quick assets to current liabilities = 1.5:1

Conclusion:

Your quick ratio should be at least 1:1 otherwise you may not be able to pay your short-term debts as they become due.

3. Cash Flow Forecast

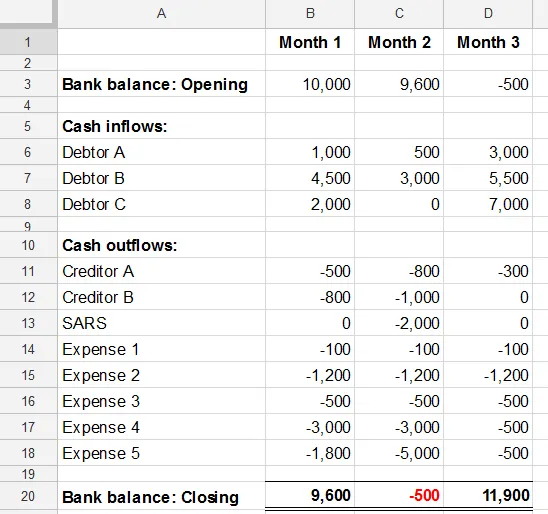

A cash flow forecast also calculates whether you’ll be able to pay your current liabilities when they become due, but it is more in-depth than a current or quick ratio.

The calculation is simple: cash inflows less cash outflows. You slot your income and expenses into columns for the dates when they are due to be paid or receivable. You can set up your cash flow forecast monthly, weekly, or even daily. It’s possible to do this exercise manually, but there are several apps available that sync with your accounting software to make a cash flow forecast a breeze.

If your cash flow forecast is negative at any time, you may fall behind on payments. The ideal is to have a positive cash flow, with enough funds to pay your current debts and an additional buffer for a rainy day.

Here is an example of a simple cash flow forecast drawn up in excel:

4. Inventory Turnover

It’s not good for your business if you have too much cash tied up in stock. You also don’t want to run out of stock as you’ll lose sales if you don’t have products to sell or if you have to halt production because you don’t have the necessary raw materials. There is a delicate balance between too much and too little stock, and every business and industry is different. For instance, an inventory turnover ratio that works for a restaurant may not be ideal for a business operating on a seasonal schedule. A restaurateur wouldn’t want to keep fresh vegetables for more than a couple of days, while a manufacturer who sells products only during winter times may want to build up inventory during the summer, which means stock should pile up for quite a few months.

Example 1

Let’s assume the following:

- Cost of sales: 100,000

- Starting inventory: 180,000

- Closing inventory: 220,000

Calculation:

Cost of sales / average inventory (for the same period)

= 100,000 / ((180,000 + 220,000)/2)

= 0.5 or 50%

Conclusion:

In this example, half the inventory was sold during the month. In other words, it will take about two months to sell all the inventory for this company.

Example 2

Let’s assume the following:

- Cost of sales: 100,000

- Starting inventory: 2,500,000

- Closing inventory: 2,400,000

Calculation:

Cost of sales / average inventory (for the same period)

100,000 / ((2,500,000 + 2,400,000)/2)

= 0.04 or 4%

Conclusion:

In this example, only 4% of the stock was sold during the month. It will take 25 months – more than two years – to sell this company’s inventory.

5. Accounts Receivable Turnover Ratio

In an ideal world, all customers will pay in cash, and you won’t have any debtors. Unfortunately, that’s not always possible. The key with debtors is to keep it low and to recover debts as soon as possible. Late-paying debtors will affect your cash flow, and you’re more likely to lose some debts completely if a debtor can’t pay.

Example

Let’s assume the following:

- Debtors beginning of the year: R120,000

- Debtors end of the year: R150,000

- Turnover for the year: R1,200,000

Calculation:

Turnover / average debtors

= 1,200,000 / ((120,000+150,000)/2)

= 8.88 times

This business collects its receivables 8.88 times per year.

You can also work out how long it takes for customers on average to pay their bills:

365/8.88 = 41.1 days

Conclusion:

If your payment terms are 30 days, then your debtors are taking too long to pay. If you have a 60-day policy, your debtors pay well.

If you have any questions on how to measure the health of your business, or you need help calculating any of these ratios, get in touch with Contador Accountants.