Do you know how to calculate the medical tax credits that you can deduct from your taxation for medical expenses paid during the year? Do you know what qualifies as medical expenses and who can be classified as your dependants?

The medical tax credit system that SARS uses to determine how much you can deduct from your taxation is often confusing to taxpayers. After reading this article, medical tax credits will finally make sense to you. It’s actually not that complicated!

There are two types of medical tax credits:

- A credit on contributions made to your medical aid

- A credit on additional medical expenses you paid that were not covered by your medical aid.

If you didn’t belong to a medical aid scheme during the year, you can only claim a tax credit under the second type.

Medical Scheme Fees Tax Credit (MTC)

This credit allows you to claim a rebate for contributions made to a registered medical aid. The rebate is deducted from your normal tax.

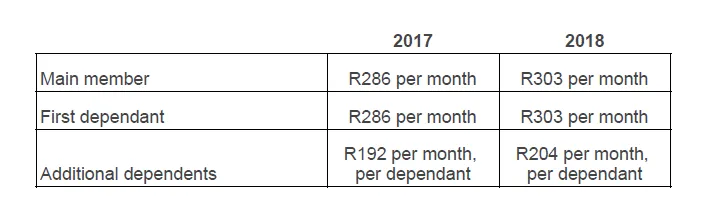

The monthly medical tax credits are as follows:

Additionally, if you only contributed to a medical scheme for a portion of the year, you can only claim a tax credit for those months for which you contributed to the fund.If you didn’t contribute to a medical aid during the year, you cannot claim a credit under this section.

Additional Medical Expense Tax Credit (AMTC)

The AMTC is a tax credit that you can claim in addition to MTC on all out-of-pocket medical expenses paid. The credit is handled as a rebate to reduce your normal taxation.

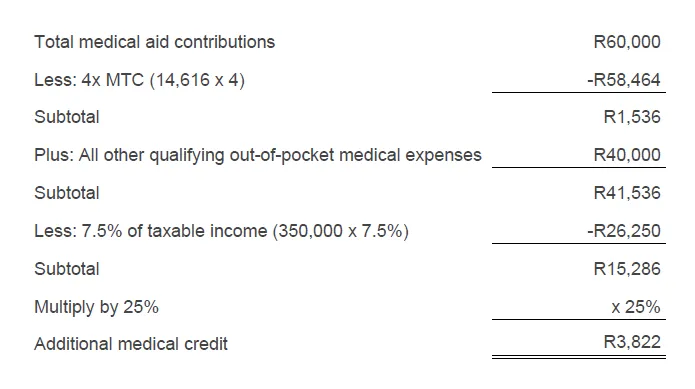

Any taxpayer can claim 25% of:

- the amount paid to your medical scheme that exceeds 4 times the amount of the medical tax credit that you are entitled to, plus

- the amount of qualifying medical expenses paid out-of-pocket

- that exceeds 7.5% of taxable income.

If you are 65 years or older, or you or one of your dependents has a disability, you can claim the following:

- 33.3% of the amount paid to your medical scheme that exceeds 3 times the amount of medical tax credits you are entitled to, plus

- 33.3% of qualifying medical expenses paid out-of-pocket.

This is quite a mouthful, and you probably feel lost right now, so let’s rather explain with the help of an example.

Medical Tax Credits: Example

Jane pays for the medical expenses for her family. For the 2018 year, we can assume the following:

- Jane’s taxable income: R350,000

- Medical contributions paid to the medical aid: R60,000

- Out-of-pocket medical expenses paid: R40,000

- Jane is married and has three children.

MTC:

AMTC:

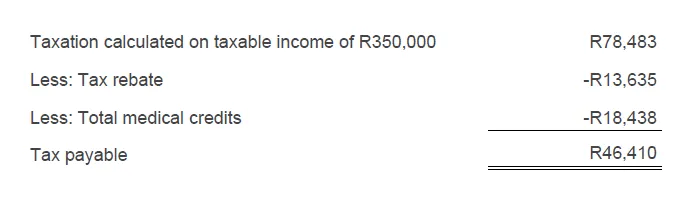

Total medical credit: R14,616 + R3,821.50 = R18,437.50

How does this look in the tax calculation?

Who Is Classified as a Dependent?

You can’t claim medical expenses paid on behalf of just anybody. This list specifies people who can be classified as dependents:

- Your spouse

- Your children, including stepchildren and legally adopted children, if:

- not older than 18 years

- not older than 21, entirely or partly dependant on you for maintenance, and they are not liable to pay normal tax

- not older than 26, a full-time student, entirely or partly dependant on you for maintenance, and not liable to pay normal tax

- has a disability and is dependant on you for maintenance

- Any other family member that is dependent on you for their maintenance, like a parent, grandparent, sibling, or grandchild

Which Medical Expenses Can You Claim?

Not all medical expenses can be claimed, such as over-the-counter supplements and cough syrup.

Here is a list of qualifying medical expenses. You can claim these costs if they were paid during the tax year for either yourself or one of your dependents:

- Amounts paid to a medical practitioner, dentist, optometrist, homeopath, neuropath, osteopath, herbalist, physiotherapist, chiropractor, or orthopedist for services rendered or medicine supplied

- Fees paid to a nursing home or hospital, or for home nursing expenses paid to a registered nurse, midwife, or nursing assistant

- Fees paid to a pharmacist for medication supplied on prescription

- Medical expenses incurred outside of South Africa for services similar to what you would have received in SA

- Expenses paid in consequence of a physical impairment or disability for qualifying expenses as prescribed by the Commissioner

Remember to hang on to your pharmacy slips, doctors bills, and other expenses to make sure you don’t lose out on expenses you could have claimed.

If you’re still confused about how the medical tax credit system works, or you have questions about anything we did not discuss in this article, please get in touch with Contador Accountants so that we can help you get clarity.