A question that we often get from small business owners is whether it’s better to distribute surplus profits as a salary or as a dividend to the owners.

There is no simple answer, so to answer this question, we need to look at the tax implications of the different options.

Paying a Salary

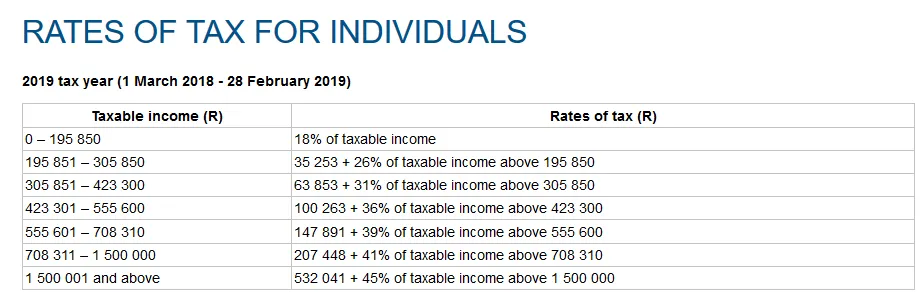

Salaries are taxed according to the income tax tables for natural persons, which works on a sliding scale from 18% to 42% (see below).

This means that the amount of taxation the owner will pay on additional income will differ from person to person, depending on which income bracket he falls in. The following examples best explain this:

Scenario 1:

Let’s say you have an additional R100,000 that you want to pay out. If this is the only income the owner received, he’ll be taxed at 18%. Here’s the calculation (not taking additional rebates or deductions like medical and travel allowances into account):

- Taxation on income: 100,000 x 18% = R18,000

- Less primary rebate: 18,000 – 14,067 = R3,933

- Amount paid to owner: 100,000 – 3,933 = R96,067

Scenario 2:

If the owner already received a salary and this R100,000 is an additional income, then the picture will look a bit different. Let’s say he already received a salary of R1,500,000 during the year. In this case, he’ll be in the highest income bracket, which is taxed at 45%.

- Taxation on additional income: 100,000 x 45% = R45,000

- The primary rebate has already been used up, so we’ll ignore it for this calculation.

- Amount paid to owner: 100,000 – 45,000 = R55,000

As you can see, there’s a big difference in the money the owner will take home between these two scenarios.

Paying a Dividend

Dividends are taxed at a rate of 20%. But this doesn’t mean that you only pay 20% tax on dividends, in fact, you pay 42.4%. Let us explain this with an example:

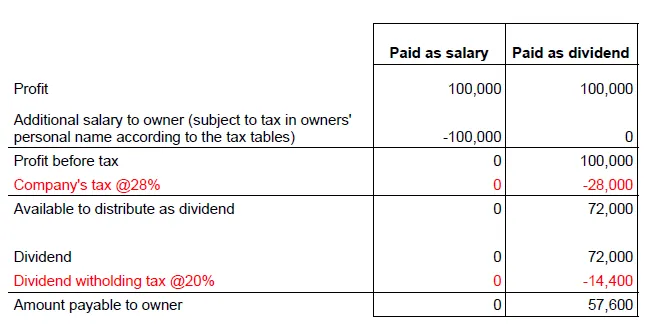

Dividends are paid out to the owner from after-tax profits. Where salaries reduce the profit before tax, dividends don’t. So let’s say that you have R100,000 that you want to pay out to the owner, this is how salaries and dividends differ:

- Salary: The salary will reduce the profit. Remember that the salary will now be taxed in the owner’s personal capacity (see above).

- Dividend: The dividend will not reduce the profit. The profit of R100,000 will first be taxed at 28%, which is the company’s tax rate. The remaining amount of R72,000 can now be paid to the owner, but this will be subject to a dividend tax of 20%. The amount that will be paid to the owner after dividend tax was deducted is R57,600.

The effective tax rate on dividends can then be calculated as follows:

Total tax paid divided by the distribution:

42,400 / 100,000

= 42.4%

Is There a Sweet Spot?

The highest income tax bracket is 45% for taxpayers who earn more than R1,500,000 per year, which is more than the effective dividend tax rate of 42.4%. Income under R1,5 million is taxed at 41%, which is less than the effective tax rate on dividends.

Should you already earn more than R1,5 million, or the additional dividend will push your income over this amount, then it’s better to distribute the additional income as a dividend. If your total income is less than R1,5 million, then it will be better to distribute the income as a salary.

What If My Company Is a Small Business Corporation?

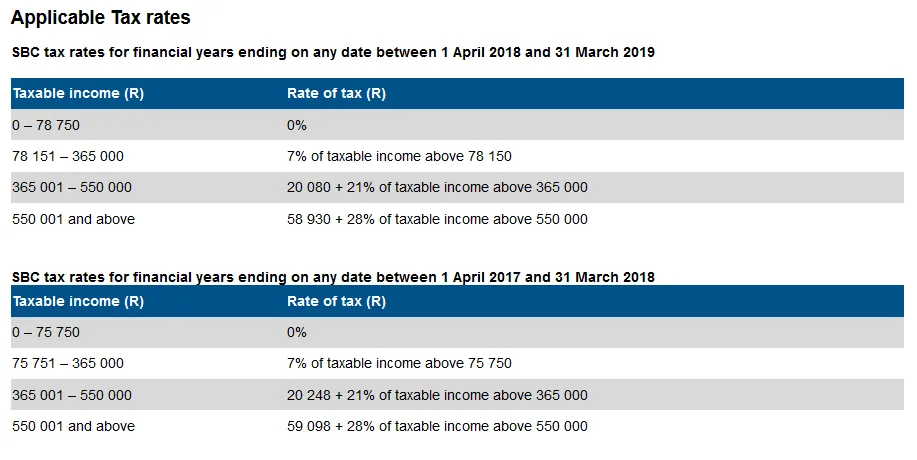

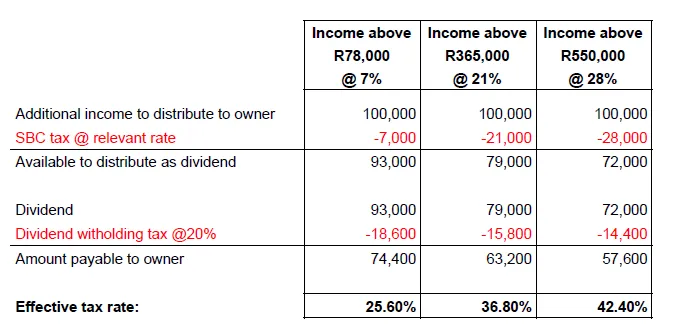

If your company is a Small Business Corporation (SBC), the calculations will look quite different. Where companies are taxed at a flat rate of 28%, SBCs are taxed according to a sliding scale, ranging from 0% for taxable income under R78,150 to 28% for income above R550,000, which makes everything so much more complicated.

Let’s compare three different scenarios. Please note that the profit before tax for each of these scenarios will be different, and we’re only looking at the additional amount of R100,000 that will be distributed to the owner.

The effective tax rate for each of these brackets is different.

I Need Help Calculating the Best Option!

As you can see, there are numerous rules to take into account and tax rates to apply for different scenarios – and we haven’t even demonstrated every scenario. There may be additional deductions or fringe benefits you have to take into account when calculating your personal tax. Or there may be small business corporations deductions that you didn’t even know about.

Another factor to take into account is that your salary should be market-related otherwise SARS may raise an eyebrow.

Whenever you’re faced with the decision of whether to distribute profits as a salary or a dividend, we suggest that you get in touch with us so that we can calculate the best option for you.