Section 12J: Venture Capital Companies

Venture capital companies (VCCs) have been around since 2009 – introduced to stimulate the private sector and the South African economy as a whole – but it was only after the amendments made to the act in 2014 that it really took off.

There are currently over a hundred Section 12J VCCs in South Africa.

But, why should you care?

When investing in a registered VCC, you can receive a very generous tax relief. Who doesn’t want to reduce their tax bill?

How Does It Work, and Who Qualifies?

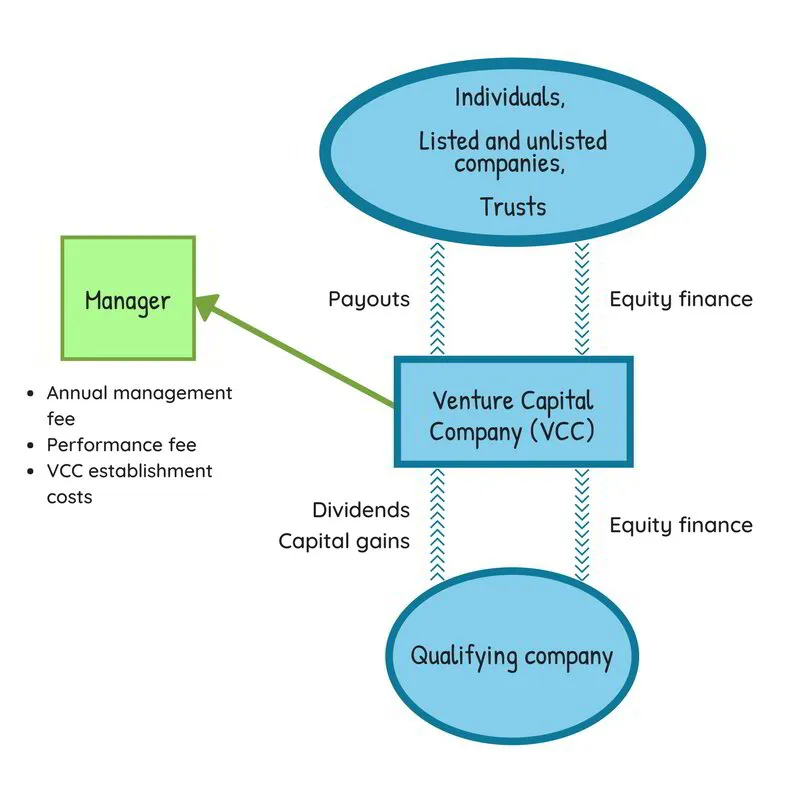

Investors – you and me – can buy shares in a venture capital company. In turn, the VCC will invest the funds they received from investors, less a management fee, in qualifying investee companies.

The investee company will pay dividends and capital gains to the VCC, and the VCC will distribute those returns to the VCC investors.

There are some rules, though.

To qualify, a venture capital company must be:

- A South African entity

- Trading primarily inside the country

- Licensed by the Financial Services Board (FSB)

- Registered with SARS

- Though not required, it’s good practice for them to register with the South Africa Venture Capital and Private Equity Association (SAVCA)

Certain economic sectors are excluded from qualifying as an investee company. These include companies that:

- Trade in immovable property, except for hotels

- Offer financial services like banking, insurance, moneylending, and hire purchase financing

- Provide financial and advisory services, like legal, tax, audit, accounting, stockbroking, and management consulting services

- Operate gambling facilities like casinos

- Manufacture, buy or sell: liquor, tobacco products, or arms and ammunition.

A VCC is not allowed to invest more than 20% of their funds in a single qualifying investee company. This is to spread the risk and to support more privately owned companies.

VCC shares cannot be listed, and in order to make use of the tax benefits, shares need to be equity shares. Or, in other words, there may not be any rights attached to the shares, like guaranteed dividends.

Investing in renewable energy companies is a favourite among VCC companies, and investments in hospitality could help our tourism industry. If you’re operating in one of these industries, make sure you approach VCCs should you need external investors.

Understanding the Tax Benefits of Investing in a VCC

As an investor, you can claim the full amount used to buy the shares in an S12J venture capital company as a deduction from your income in the year you made the investment.

The proceeds, or dividends, you receive will be taxable like any other dividend. The current dividend rate is 20%.

Should you receive capital gains, you’ll need to pay capital gains tax (CGT) on that.

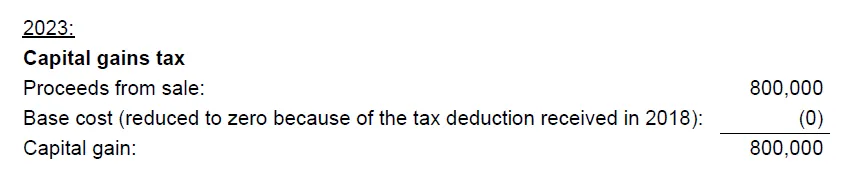

When you sell your shares, the full proceeds from the sale will be subject to capital gains tax.

Since you were able to claim the full investment amount from SARS, your base cost will be reduced to zero.

Let’s explain the tax benefits you’ll receive with an example:

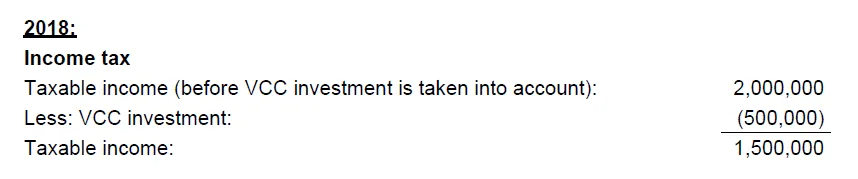

Investor x invests R500,000 in a qualifying VCC in 2018. His taxable income for the year is R2 million. 5 years later (2023), he sells his VCC shares for R800,000.

Investor x will be taxed at the highest tax rate of 45% since his taxable income falls in the category of R1,5 million or more. So, effectively, he will have saved R225,000 (500,000 x 45%) in taxation because of the VCC deduction.

Let’s assume tax rates did not change since 2018, and Investor x receives income that puts him in the highest tax category of 45%. The capital gains tax portion will be as follows:

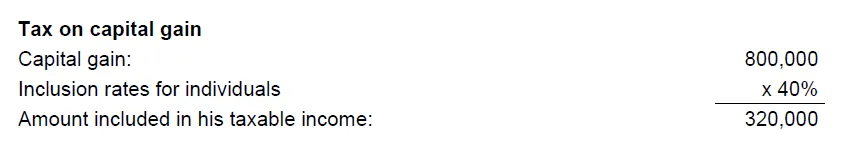

The amount of tax he’ll pay on the capital gain (ignoring all other income) would be R144,000 (320,000 x 45%).

Should investors sell their VCC shares before 5 years passed, the deduction they previously received will be recouped. This means that they will have to include the deduction they previously made as an income item, increasing their taxable income. However, in the capital gains calculation, their base cost would not be zero – they’ll be able to deduct the purchase amount from the proceeds to decrease their capital gain.

To be able to claim these tax benefits, investors must ensure that they received a ‘Certificate of investment’ from the VCC as proof.

There is no annual or lifetime limit to how much you can invest in venture capital companies.

Time is running out to make use of this tax benefit. 30 June 2021 is the end date set for Section 12J, but any investments made in VCCs up to that date will enjoy the tax benefits. There is a chance that S12J may be extended, but at this stage it is unclear.

Before You Invest, Do Your Homework

You don’t want to invest just to receive a hefty tax benefit. Essentially, you also want to receive a good return on investment (ROI).

Not all VCCs are created equal, so make sure that you investigate the companies you’re interested in, and make sure you understand their investment strategies. S12J companies can decide whether they want to invest in start-ups or mature companies, high-risk or low-risk industries, and different types of industries. The VCC’s investment goals and adversity to risk must align with yours.

If you need any help with making use of these generous tax benefits get in touch with Contador Accountants.